Key figures for beauty and cosmetics in 2021-2022

31.3%. This is the percentage of consumers who report having bought at least one cosmetic product online during the year 2020, making the beauty sector the 4th e-commerce market in terms of number of customers.

In the UK and all over the world, the beauty and cosmetics industry has been booming for several years, and more particularly on the web. Every year, in-store sales of cosmetic products decrease in favor of online sales.

Driven in particular by popular and very prominent influencers, product innovation demonstrated by brands and new digital technologies, the beauty market is a growth sector to which consumers devote a large part of their budget.

In order to find your place in the cosmetics market, and to better understand the challenges faced by retailers and e-merchants in 2020, here are some key trends and figures in the beauty industry for 2021-2022.

State of the beauty industry in the UK and internationally in 2021-2022

The beauty market encompasses different categories of products used for the care and beautification of the face, body, hair or teeth:

- Cosmetics: make-up, skin creams, baby products, sunscreens, etc.

- Hygiene and toilet products: soaps, shower gels, deodorants, toothpastes, etc.

- Hair products: shampoos, hairsprays, gels, styling foams, dyes, coloring, etc.

- Perfumery: perfumes, colognes, cologne, etc.

A key market for the UK economy, beauty is a dynamic and growing industry. Almost daily, new cosmetic brands and companies are emerging around revolutionary and original concepts.

- According to figures from analyst firm Zion Market Research, by 2024, the global cosmetics market is expected to be worth £ 660 billion, up from £ 406 billion in 2017.

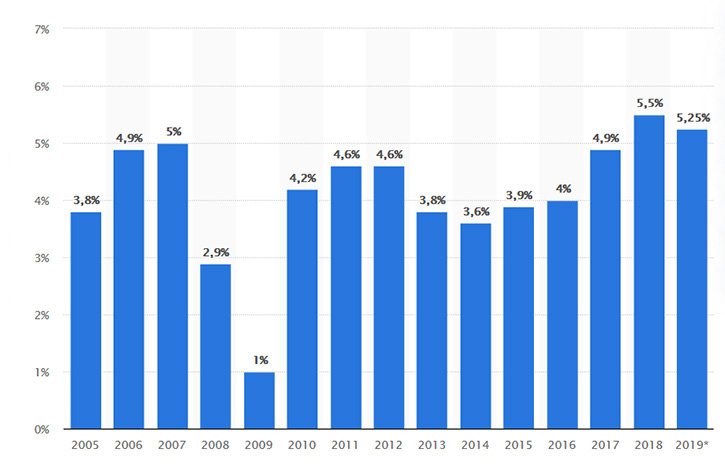

- The global cosmetics market is showing an impressive annual growth rate: 4.9% in 2017, 5.5% in 2018 and 5.25% in 2019.

- In 2020, its growth rate is again expected to be between 5 and 6%.

Growth rate of the global cosmetics market between 2005 and 2019 – Statista.

- Asians are the biggest consumers of cosmetic products (41% of the market in 2019). North Americans (24%) and West Europeans (18%) follow.

- France is the leading exporter and dominates the global cosmetics market, with a turnover of nearly £ 14 billion.

- United Kingdom is 10th with a turnover of £ 1.80 billion and a global export market share of 3.6%.

The beauty market is divided among the major historical players who shine at the global level, and alongside which are developing many SMEs:

L’Oréal is the world leader in the cosmetics market, with sales of £ 34.3.8 billion in 2019. Unilever and Estée Lauder are in second and third place, with respectively business of £ 17.1 billion and £ 10.85 billion.

According to a study conducted in 2019 for the FEBEA (French Federation of Beauty Companies), 82% of companies in the beauty sector have a single family shareholder.

Each year, the number of FEBEA members rise by 5%.

With the birth of a real environmental awareness among consumers, the debates on parabens, endocrine disruptors and potentially carcinogenic ingredients, the beauty market is one of the sectors most affected by the wave of “natural” and the trend to “sustainable consumption”.

Thus, although the majority of buyers continue to use conventional cosmetics, they increasingly favor environment friendly, healthy and natural products, as well as the various certifications (organic, vegan, etc.) that did not exist 20 years ago:

- Global sales of natural cosmetics increased 8.8% between 2018 and 2019.

- The global natural cosmetics market could reach £ 36.5 billion in 2024.

- Unilever is the second world largest compagnies for cosmetics.

- In the first half of 2019, the labeled brands recorded a 31% growth in their sales compared to the same period of the previous year.

Meanwhile the organic and natural trend continues to take root, with a 23% growth in 2020 in the UK according to the Soil Association.

The sale of cosmetic products in figures

The UK is one of the three leading cosmetics consumers in Europe behind Germany and France.

The sale of cosmetic products is broken down as such:

- 25.1 % : toiletries.

- 22.3 % : skincare.

- 19 % : fragrances.

- 17.9 % : haircare.

- 15.6 % : colour cosmetics.

In 2019 consumer expenditures for cosmetic products has reached £ 32.5 million.

Online share in the beauty industry

When stores are closed or going to stores is not possible, consumers overwhelmingly retreat into e-commerce. Thus, in full lockdown, online beauty sales increased 73% over the previous year, over the same period.

- In France, online sales of beauty products represent more than 7% of the market. This is less than in the US and UK where e-commerce accounts for around 15% of sales.

- Between 2016 and 2017, internet sales of makeup products jumped 44%, 29% for beauty care and 22% for perfumes.

58% of women say they have ordered cosmetics online. Among them, more than half make their purchases on their smartphone. - According to a study on the cosmetics market carried out in 2020 by SEMrush, Internet users overwhelmingly visit beauty sites using their smartphones:

- 94% of Yves Rocher’s site traffic comes from a mobile device.

- 93% of L’Oréal site traffic comes from a mobile device.

- 85% of L’Occitane website traffic comes from a mobile device.

While consumers, and more particularly “millennials” (18 – 34 years old), are turning more and more to e-commerce to buy cosmetics, the in-store experience is still privileged because it offers the possibility of testing the products. Thus, 80.7% of global sales of beauty products are still made in stores.

However, because it allows a wider choice, avoids waiting at the checkout or having to move, online sales, but also and especially the influence of the web on purchasing decisions, tends to progress even more in the years to come, running the risk of cannibalizing in-store purchases.

Thus, a study carried out in 2017 for Facebook revealed that 72% of women who buy a beauty product are influenced by their “online experience”, that is to say by all the digital marketing and communication channels: site e -commerce, blog and social networks (Instagram and YouTube in the lead).

In 2020, cyber shoppers in the UK favored the online purchase of beauty products from the following companies: Boots, Superdrug and QVCUK.

2020 ranking of beauty e-commerce sites in number of customers – Salience

However, the balance of power between traditional players and small independent brands differ greatly on the Internet and at the point of sale. Thus, pure players (companies operating only on the web) do not fail to compete with the mastodons of the beauty industry:

- In stores, the 20 leading brands in the sector share 96% of cosmetics sales. On the web, they only represent 14% of transactions, the remaining 86% being distributed among independent brands.

Among cosmetics consumers, bloggers on the lookout for new products represent a privileged segment for beauty brands. Thus, a study carried out among 500 influential bloggers reveals interesting figures:

- 13% of them buy only on the Internet, while 29% only buy in stores.

- A large majority of them (56%) make both online and in-store purchases.

- 30% of consumers systematically consult comments and opinions about a product; this figure climbs to 78% for bloggers.

- 80% would like the click & collect system to develop more in stores.

Beauty product purchasing trends and criteria

The most purchased beauty products on the Internet by European women are: day cream, nail polish and mascara.

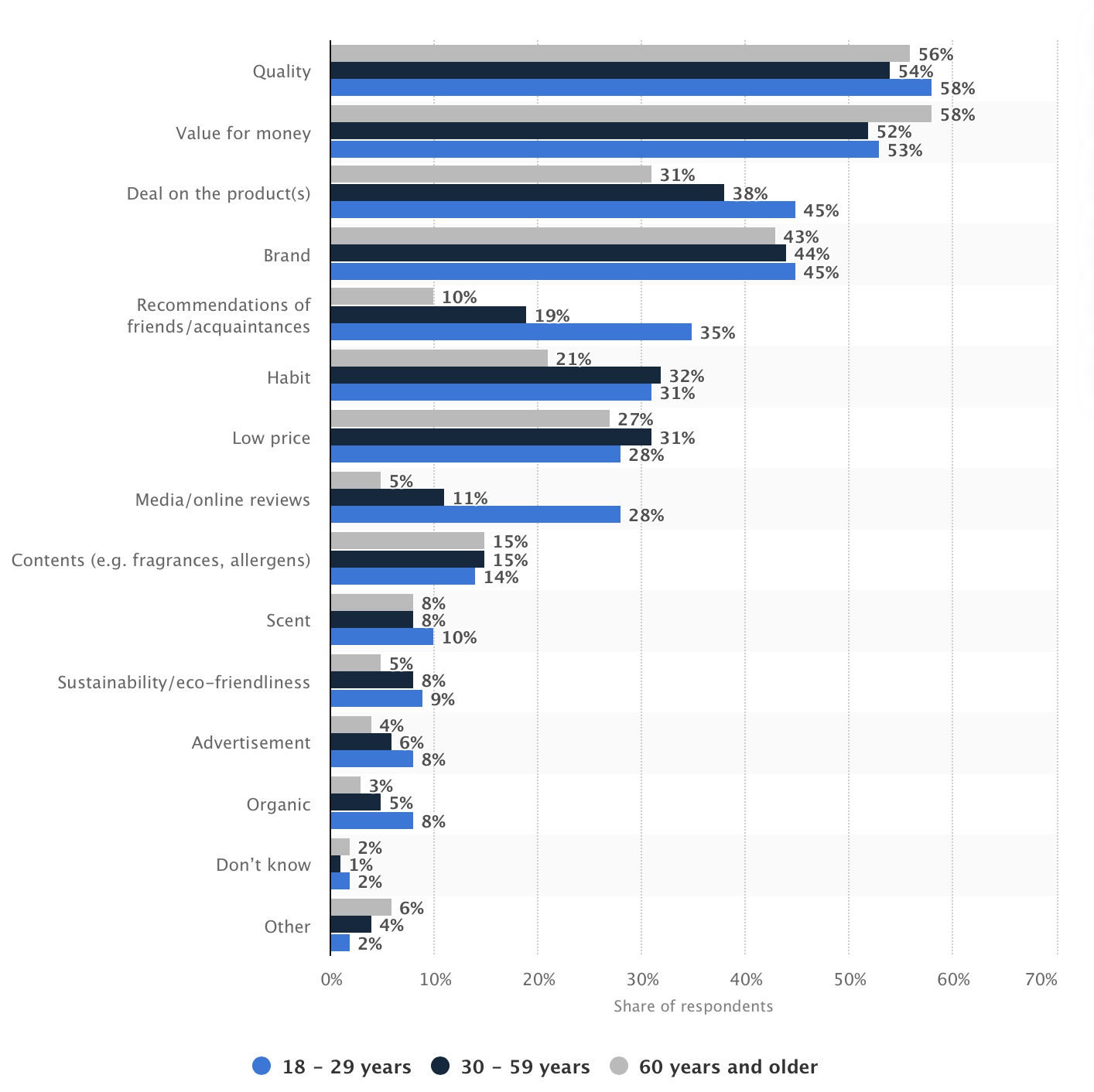

Cyber shoppers take several criteria into account before buying a cosmetic product:

- about 30% pay attention to the price of the product.

- about 15% check the composition and ingredients.

- More than 50% are interested in the quality of the product.

Other selection criteria include: reputation and brand commitments, label / certification, opinions of other consumers and packaging.

Based on which criteria do you usually select decorative cosmetics (foundation, lipstick, mascara etc.)? Satista

The beauty industry on social networks

According to the influencer platform Hivency, 4 in 5 consumers buy a product after seeing a recommendation on social media.

Thus, in the beauty and cosmetics industry, social networks and their influencers occupy an increasingly prominent place, especially among the generation of “millennials”, addicted to their smartphones, Instagram and YouTube:

- 56% of women follow beauty influencers.

- Beauty addicts spend more than two hours on social networks looking for news in the sector.

- In the top 10 of the most effective brands on social networks, only Dior is a traditional player; the others are either brands created by celebrities like Kylie Jenner and Rihanna (with Kylie Cosmetics and Fenty Beauty respectively), or independent cosmetic brands that initially went online before being distributed through physical outlets.

- France has 3,000 beauty influencers, the UK 5,900. 6% of them are followed by more than 100,000 followers.

In conclusion, the figures for the beauty sector prove that the market still has a bright future ahead.

Driven by very active influencers and listened to on social networks, but also because they save time and energy, online transactions for cosmetic products are tending to become widespread. However, in-store buying is still the norm, in that it allows you to test a product before buying it. But new technologies such as augmented reality, which allows you to virtually try a product, may well help to reverse the trend.

In addition to e-commerce, there are several growth drivers for the beauty market. First, the growing demand for organic and natural products. Then, personalization, which makes it possible to adapt a cosmetic product according to the type of skin, the weather or the consumer’s state of fatigue; a trend strongly linked to the rise of “homemade” cosmetics. Criteria that encourage brands to show more transparency and traceability in the composition of their products.

It is certain that only those who will be able to adapt to new technologies and consumer habits will succeed. If you would like to know more about the communication and marketing strategies to adopt to promote your company or cosmetic brand, Alioze is specialized in the communication for the beauty industry.

Sources :

- lsa-conso.fr :

- FEBEA :

- premiumbeautynews.com :

- frenchweb.fr

- toute-la-franchise.com

- forbes.fr

- avise-info.fr

- lesechos.fr

- mariefrance.fr

- professionbienetre.com

- loreal-finance.com

- pricecomparator.pro

- lemonde.fr

- mbamci.com

- semrush.com

- linkinfluence.com

- magazine-avantages.fr

- newsroom-publicismedia.fr

- journalducm.com

Leave a Reply

You must be logged in to post a comment.